How only R500 can settle a debt of R30,000

Budgeting and knowing where your money is going is great, but how do you use that knowledge to get out of debt?

If you’ve spent some time analyzing your actual expenses, I can guarantee that there will be a place where you can save some money. Whether it’s cutting down on take-out, reducing your data usage, or finding smart ways to do banking, there are always areas of waste that create an opportunity to save – even if not. than R500 per month.

When what you owe on your credit cards, bank cards, and personal loans looks a lot like the GDP of a small country, you can feel like R500 is just a drop in the ocean. and will never have an impact on reducing your debt level. The temptation is to just bury your head in the sand and use the R500 for retail therapy instead! The good news is that the R500 is a lot more powerful than you might think.

While editing the South African version of Total Money Makeover by American money expert Dave Ramsey, I discovered the snowball effect of debt repayment, a very powerful tool for getting out of debt.

The concept is very simple: rather than trying to speed up all your debt repayments, select your smallest debt first and pay it off as quickly as possible. First, it’s a big psychological victory to have debt settled, but second, it frees up the money you were spending on paying that debt to target your next debt. With the second debt settled, you have now released the debt repayments from two loans added to your R500 budget savings and to meet your larger debts.

In my book Maya on Money: Implement your Money Plan, I used Dave Ramsey’s snowball effect to show how just an additional 500 Rand each month could pay off 30,000 Rand of debt in 2 years.

In this scenario, you have the following debts:

- R2000 clothing account, minimum repayment R200 per month

- R3000 retail store account, R300 minimum repayment per month

- R10,000 bank credit card, minimum reimbursement R300 per month

- R15,000 branded credit card, R500 minimum repayment per month

Months 1 to 3

You put an additional R500 into your clothing account, increasing the payout to R700 pm. Within three months, the account is refunded. You close the account immediately!

Months 4 to 6

Use the R700 you put into the clothing account to increase your payments to your retail store account, increasing those payments to R1000 per month. The retail store account is settled within three months. Again, you must close the account to avoid the temptation to use it otherwise you derail the debt repayment plan.

Months 7 to 14

With store accounts closed, now is the time to tackle your credit card. Take the R1000 you were paying from the retail store account and increase your credit card payments to R1300. Within nine months, your credit card is paid off. Close the account or lower your credit limit to just 500R. Credit cards can be useful payment methods, but only if you’re transferring money at the start of the month.

15 to 23 months

The R1300 used to pay off the bank credit card is now used to add to the branded credit card refunds bringing the refund amount to R1800. In just nine months, this card is paid off.

You are out of debt after finding only R 500 more each month in your budget. This of course assumes that you stay within your budget and that you do not take out any other credit during this period. Not only are you not in debt, but you have R1800 of disposable income to start investing.

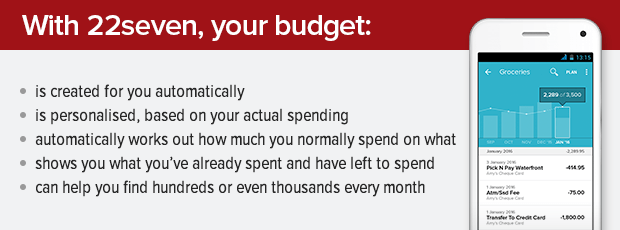

Hopefully this exercise will provide some motivation to start with this budget. As a member of Show Your Money Who’s Boss campaign you can download the 22seven app and track your net worth which is a graphical illustration of the money you have and the money you owe. As you settle this debt, your net worth will increase.